Why Predicting Market Tops Is a Losing Game: S&P 500 and Dow Insights | Episode 269

By Jason McIntosh | 6 December 2024

Why Trying to Call Market Tops Can Hurt Your Portfolio

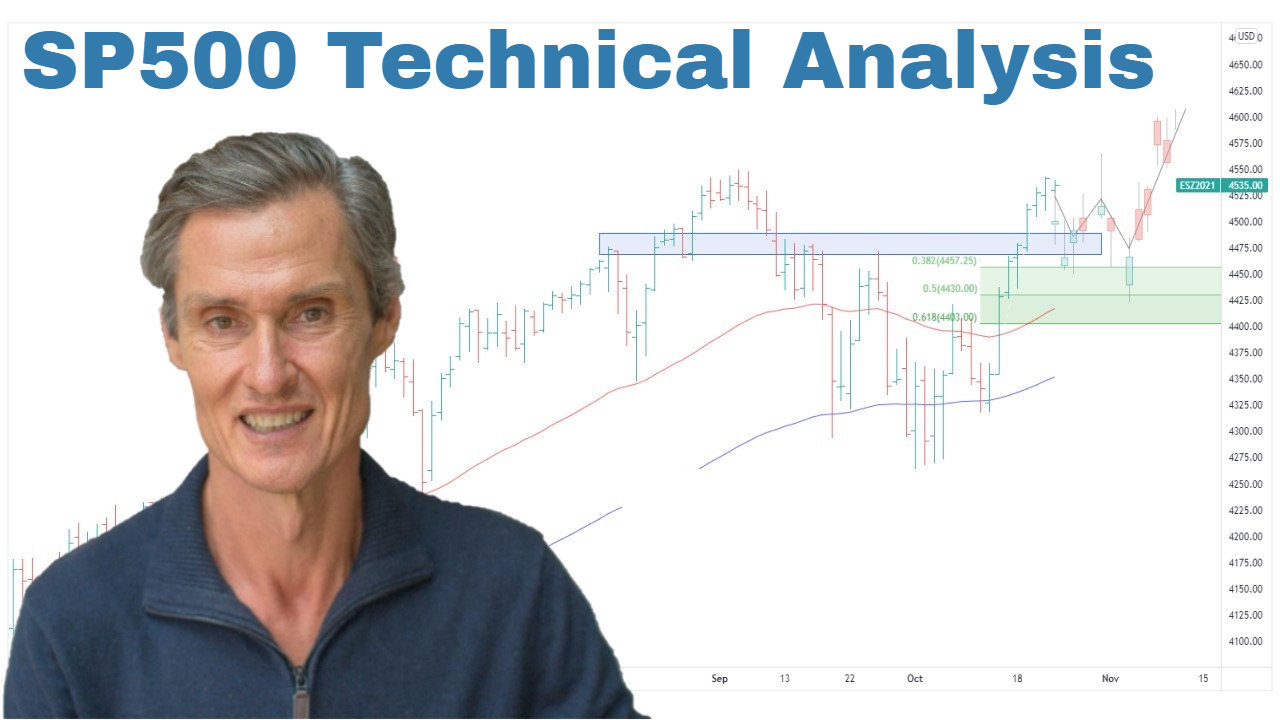

The S&P 500 has hit yet another all-time high, reinforcing a key lesson for investors: predicting market tops is a tough and often costly endeavor. By focusing on technical analysis and staying aligned with trends, you can avoid unnecessary risks and potentially maximize your returns. Here’s why trend-following beats top-picking and what the latest charts for the S&P 500, Dow, and NASDAQ are telling us.

The S&P 500: A Bullish Backdrop

Despite the temptation to anticipate a market peak, the S&P 500 continues to exhibit a structurally bullish setup. Key indicators include:

- Rising 50-day moving average: This trend-following tool shows upward momentum.

- Price above moving averages: A classic sign of a bullish market.

The S&P 500 isn’t alone—other major U.S. indices like the Dow Jones Industrial Average and the NASDAQ show similar patterns, with new highs and bullish conditions dominating.

👉 Learn more: What is a Moving Average?

The Dow: A Picture-Perfect Trend

The Dow Jones has maintained one of the cleanest trends among U.S. indices.

- Midyear Consolidation: After a strong rally from October lows, the Dow paused midyear, allowing it to reconnect with its moving averages.

- Rising Lows: A series of higher lows and higher highs indicates strong underlying demand.

- Sustainable Growth: Unlike rapid accelerations, which can be a red flag, the Dow’s steady upward movement suggests a sustainable trend.

The NASDAQ: Volatility with Momentum

The NASDAQ, while more volatile, has also reached new all-time highs. Historically, its bullish trends have extended far longer than most experts anticipate.

Key takeaway: The odds favor more upside for the NASDAQ in this current phase. However, as always, managing risk is critical.

Why Picking Tops Rarely Works

At some point, every bull market will peak. However, predicting exactly when this will happen is nearly impossible—and trying to do so can lead to missed opportunities.

- Many strategists call for a top long before it happens, missing out on significant gains.

- Staying in sync with the market through trends, rather than fighting them, has historically been more profitable.

Pro Tip: Instead of predicting tops, use wide trailing stops to exit after a trend reverses. This allows you to ride the bulk of the trend while protecting against significant losses.

👉 Learn more: What is a Trailing Stop?

Big Profits Are Made by Staying Optimistic

“The big money is made by being optimistic that a trend will extend, rather than pessimistic that it’s nearing an end.”

This mindset has proven effective over the past few years, with the S&P 500 and other indices defying bearish predictions to deliver strong returns. Here’s why:

- Wide trailing stops allow you to capture the majority of a trend.

- Focus on trends rather than reversals for consistent decision-making.

Key Takeaways

- The S&P 500, Dow, and NASDAQ are all in structurally bullish trends.

- Trying to call a market top can result in missed opportunities and lost profits.

- Use technical tools like moving averages and trailing stops to stay aligned with trends.

- Consolidations and pullbacks are natural and healthy parts of a long-term trend.

By focusing on trend-following and resisting the urge to anticipate a market peak, you position yourself to capitalize on sustained growth while managing risk effectively.

👉 Want to stay ahead of market trends? Join our Weekly Strategy Sessions.

Looking for the best ASX stocks to buy now?

Motion Trader‘s algorithms scan more than 2,000 ASX stocks daily in search of medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

Try a no obligation FREE 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.

Video Links

For reference to the topics discussed:

10:15 SP500 makes another record high (resist this temptation)

13:05 THIS is one of the most important things I can tell you

14:15 Here’s the bottom line for US stocks

15:00 Big money is made by doing THIS

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).