S&P 500 Technical Analysis: Record-Breaking Year and Future Outlook | Episode 267

By Jason McIntosh | 29 November 2024

The S&P 500 has had an exceptional year, with returns through November 2023 surpassing all but three years since 1990. This remarkable performance raises questions about market sustainability and potential future scenarios. Let’s dive into a comprehensive technical analysis of the S&P 500 and explore what history tells us about similar strong years.

Current Market Dynamics

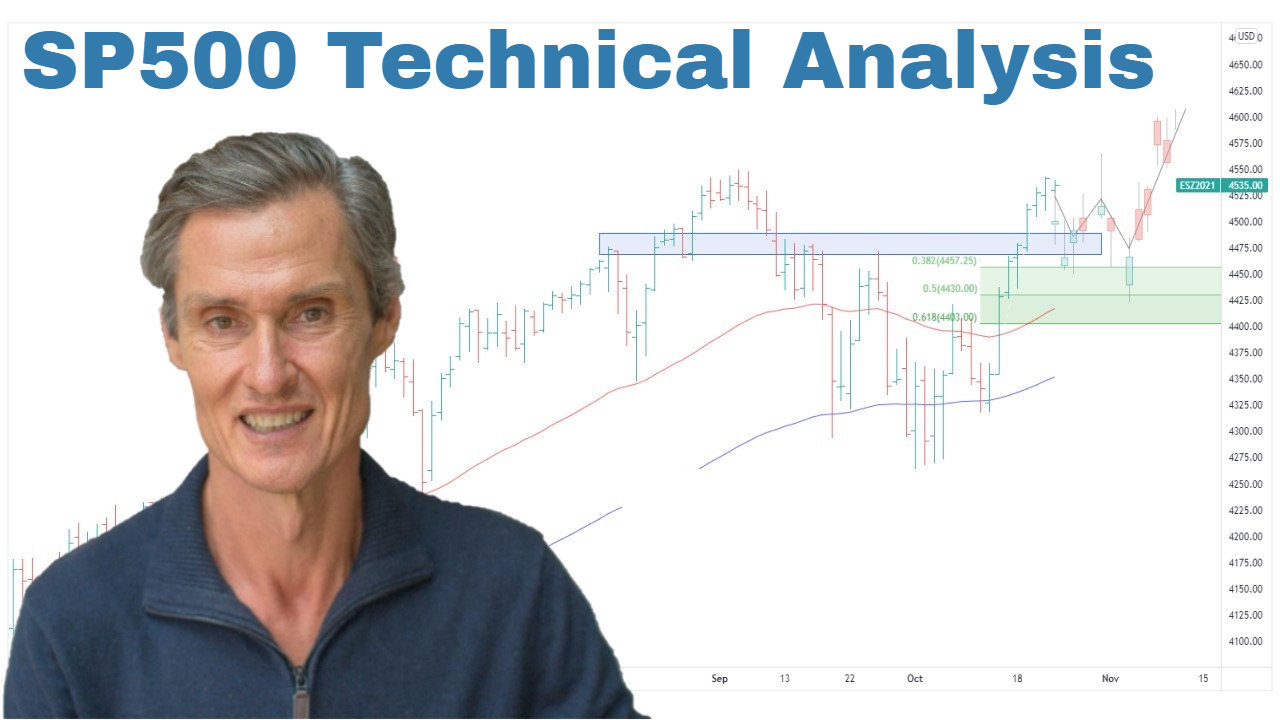

The S&P 500 recently hit a new all-time high, maintaining its bullish trend. However, there are some interesting divergences in the market:

- NASDAQ Non-Confirmation: While the S&P 500 reached new highs, the NASDAQ hasn’t followed suit, creating a non-confirmation scenario.

- Equal Weight Outperformance: Both the S&P 500 and NASDAQ equal-weight indices have outperformed their market-cap weighted counterparts, indicating broad market participation.

Technical Analysis Tip: Non-Confirmation

Non-confirmation occurs when related indices fail to confirm new highs or lows in the primary index. It can sometimes signal potential weakness or a change in trend.

Historical Perspective: Strong Years and What Followed

Looking at the three years that outperformed 2023 through November (1995, 1997, and 2013), we can draw some interesting insights:

- Continued Strength: All three years were followed by further gains in the subsequent year.

- Consolidation Periods: Each strong year was typically followed by multi-month consolidations or pauses.

- Resilience: Despite occasional sharp pullbacks, the overall trend remained bullish in the following years.

S&P 500 historical performance analysis

Understanding past market behavior can provide valuable context for current trends. Explore more about S&P 500 historical performance analysis.

Technical Indicators Supporting the Bull Case

Several technical factors suggest the current bull market may have room to run:

- Rising moving averages (50-day and 100-day)

- Price action consistently above these moving averages

- Broad market participation, as evidenced by equal-weight index outperformance

Technical Analysis Concept: Moving Averages

Moving averages help smooth out price data to identify trends. The 50-day and 100-day moving averages are commonly used in technical analysis to gauge medium-term trends. Learn more about using moving averages in technical analysis.

Conclusion: Cautious Optimism with Risk Management

While historical patterns suggest the potential for continued strength, it’s crucial to remember that past performance doesn’t guarantee future results. Investors should consider:

- Maintaining market exposure to benefit from potential continued upside

- Being prepared for consolidation periods or pullbacks

- Implementing robust risk management strategies

By staying alert to market signals and maintaining a balanced approach, investors can position themselves to capitalize on potential gains while protecting against unexpected downturns.

For more insights into technical analysis and market trends, explore advanced strategies here.

****

Looking for the best ASX stocks to buy now?

Motion Trader‘s algorithms scan more than 2,000 ASX stocks daily in search of medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

Try a no obligation FREE 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.

****

Video Links

For reference to the topics discussed:

10:45 SP500 makes new all-time-high but Nasdaq doesn’t (what it means)

12:05 This is fascinating, look what just happened

14:40 SP500 has only done this 4 times since 1990

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).