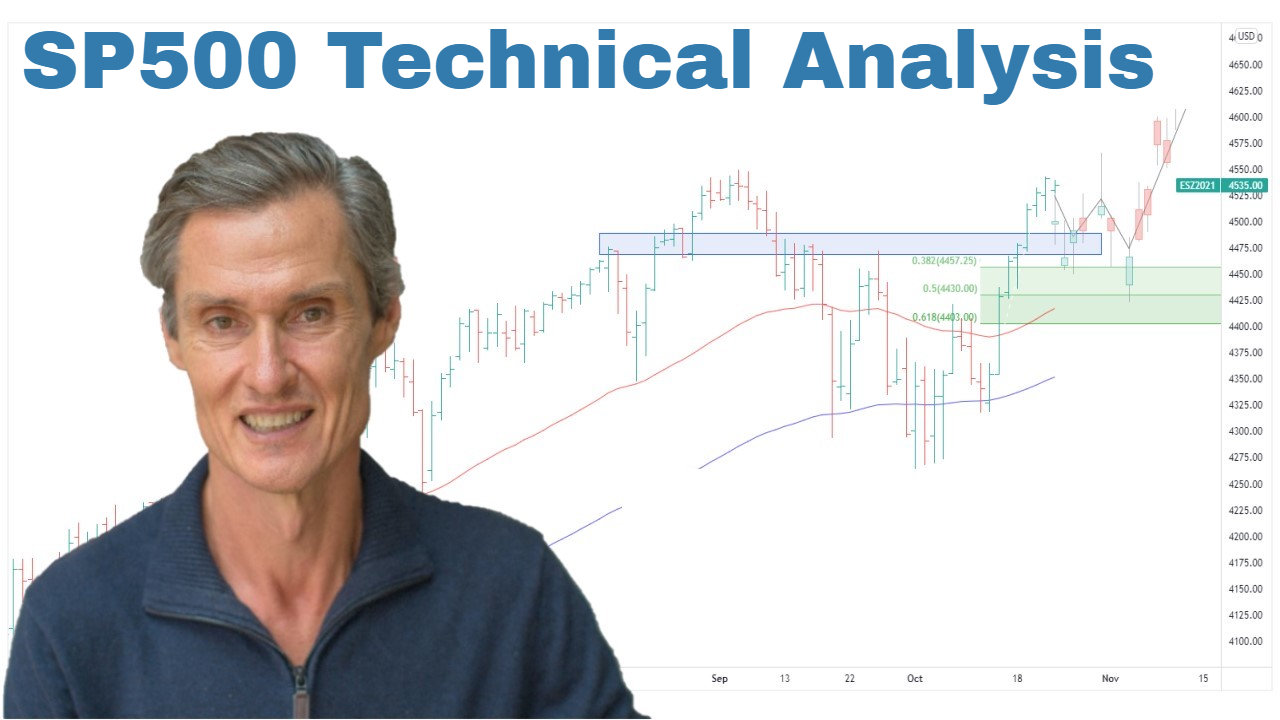

S&P 500 Technical Analysis: Post-Election Rally and Market Trends | Episode 262

By Jason McIntosh | 8 November 2024

S&P 500 Hits New All-Time High in Post-Election Rally

The S&P 500 has demonstrated a remarkable turnaround, reaching a new all-time high following the recent U.S. election. This swift change in market sentiment highlights the dynamic nature of stock market trends and the importance of robust technical analysis in navigating these shifts.

Record-Breaking Post-Election Performance

In a historic move, the S&P 500 surged 2.5% on the day after the election, marking the largest post-election day rally in the index’s history. This exceptional performance wasn’t limited to the S&P 500; the Dow Jones Industrial Average and NASDAQ also experienced similar upward trajectories, reaching their own all-time highs.

Comparing Current Market Trends to 2016 Election

To gain perspective on the current market situation, it’s instructive to compare it with the 2016 election aftermath. While historical patterns don’t predict future outcomes, they can provide valuable insights for technical analysis of the S&P 500.

Key Differences in Market Structure

- Pre-Election Market Conditions:

- 2016: The market was only 20% above its lows during the pre-election corrective period.

- 2024: The market is approximately 70% above its lows from the recent corrective phase.

- Sentiment Shift:

- 2016: Initial fears of a market crash if Trump won, followed by a rally.

- 2024: Bullish sentiment prevailing, with Trump’s potential re-election viewed positively by the market.

Learn more about market sentiment analysis

Technical Analysis: Current S&P 500 Structure

The current technical structure of the S&P 500 remains bullish, characterized by:

- Rising Moving Averages: Both the 50-day and 100-day moving averages are trending upward.

- Price Action: The index is trading above these key moving averages, a typically bullish signal.

Long-Term S&P 500 Investment Strategy

Given the current technical analysis of the S&P 500, a bullish strategy appears appropriate.

This could include:

- Maintaining Long Positions: Continue holding stocks, especially those showing strength.

- Actively Opportunity Seeking: Look for new entry points in strong sectors or stocks.

- Risk Management: Implement wide trailing stops to protect against potential market reversals.

Conclusion: Balancing Optimism with Caution

While the S&P 500’s technical analysis suggests a continued uptrend, it’s crucial to remain vigilant. The market’s rapid shift from pre-election jitters to post-election euphoria underscores the importance of a flexible investment approach. For investors looking to capitalise on current S&P 500 trends, consider:

- Regularly reviewing your portfolio’s alignment with market trends

- Staying informed about economic indicators that could impact market direction

- Balancing optimism with prudent risk management strategies

By combining technical analysis with a long-term perspective, investors can navigate the post-election market landscape with greater confidence and potential for success.

****

Looking for the best ASX stocks to buy now?

Motion Trader‘s algorithms scan more than 2,000 ASX stocks daily in search of medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

Try a no obligation FREE 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.

****

Video Links

For reference to the topics discussed:

10:30 SP500 has similarities to last time Trump won (but THIS is different)

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).