S&P 500: Navigating Conflicting Technical Signals | Episode 279

By Jason McIntosh | 17 January 2025

The S&P 500 continues to present an intriguing mix of technical signals, challenging investors to navigate a market filled with crosscurrents. While the primary trend remains upward, recent price action and underlying market dynamics suggest that caution is warranted.

Let’s break down the key developments from this week, explore the technical landscape, and outline strategies for managing portfolios in this environment.

False Breakout and Bullish Resilience

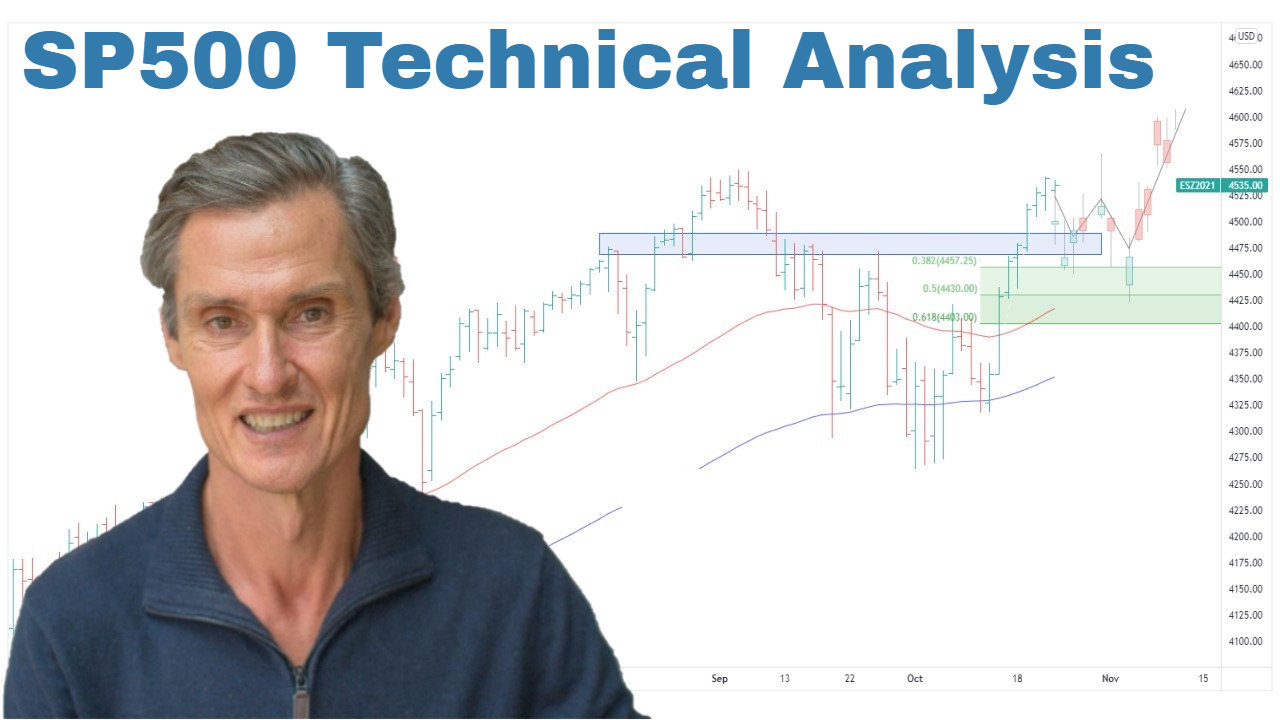

Last week, the S&P 500 appeared to be coiling for a potential breakout above its moving averages. Instead, the market saw a brief breakdown on Monday, followed by a sharp reversal, which pushed prices back into the center of the range.

Key Observations:

- False Breakout: The initial breakdown didn’t stick, with buyers stepping in to reject the sell-off. This “false break” indicates that dips are still being bought, suggesting the path of least resistance remains upward.

- Moving Averages Remain Supportive: The 50-day and 100-day moving averages are still trending upward, reinforcing the overall bullish structure.

- Key Level to Watch: Monday’s low is a critical support level. A retest and breakdown below this level could weaken the chart structure and lead to lower prices.

Equal-Weighted S&P 500: Signs of Weakness

While the market-cap-weighted S&P 500 remains resilient, the S&P 500 equal-weight version paints a different picture. This index gives equal importance to all stocks, and its performance reveals underlying market health.

Key Observations:

- Consolidation Below Moving Averages: The equal-weighted S&P 500 has spent the past five weeks consolidating below its 50- and 100-day moving averages, which are starting to roll over. This pattern often signals vulnerability.

- Recent Recovery: Prices attempted a breakdown earlier this week but have since rallied, reducing the risk of further immediate declines.

- Underlying Weakness: Over half of the stocks in the S&P 500 are trading below their 100-day moving averages, highlighting a fragile foundation beneath the broader index’s apparent strength.

How to Manage Portfolios in This Environment

Navigating conflicting signals requires a disciplined and flexible approach. While the S&P 500’s primary trend remains upward, warning signs in the equal-weighted index and broader market health shouldn’t be ignored.

Strategies to Consider:

- Stay Aligned with the Trend: The S&P 500’s trend is still upward. Avoid making premature bearish bets unless there’s a clear breakdown below key levels.

- Scale Back Risk: Reduce exposure to riskier positions. For example, avoid replacing stocks that hit exit levels and consider trimming ETF holdings.

- Use Flexible Positioning: Stay open-minded about the market’s direction. Be prepared to adjust exposure based on price action in the coming weeks.

- Avoid Rigid Convictions: Rigid views about the market’s direction can lead to poor decisions. Focus on staying adaptable and letting the market guide your actions.

- Deploy Trailing Stops: Protect gains by using trailing stops on profitable positions to minimize downside risk.

Key Takeaways for Investors

- The S&P 500’s false breakout highlights the market’s ability to absorb selling pressure, reinforcing its bullish trend.

- Weakness in the equal-weighted index and the large proportion of stocks trading below their 100-day moving averages indicate underlying vulnerabilities.

- A balanced approach—staying long while scaling back risk and remaining flexible—is essential in navigating these crosscurrents.

Final Thoughts

The S&P 500 remains in an uptrend, but mixed signals from the broader market and the equal-weight index suggest a cautious approach. By staying disciplined, managing risk, and remaining flexible, investors can position themselves to take advantage of opportunities while protecting against downside risks.

At Motion Trader, we emphasise systematic, rules-based investing to help you make informed decisions in all market conditions. Whether markets are trending higher or showing signs of fragility, our strategies provide the tools you need to navigate with confidence.

👉 Want to stay ahead of market trends? Join our Weekly Strategy Sessions.

Looking for the best ASX stocks to buy now?

Motion Trader‘s algorithms scan more than 2,000 ASX stocks daily in search of medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

Try a no obligation FREE 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.

Video Links

For reference to the topics discussed:

08:30 S&P 500 delivers a big surprise (what does it mean?)

11:05 This is the key risk for US stocks

13:20 Ego can cost these people a lot of money

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).