Is the S&P 500 Signaling a Turning Point? Technical Analysis | Episode 275

By Jason McIntosh | 3 January 2025

The S&P 500 has experienced a pullback in recent weeks, leaving investors questioning whether this is a routine dip in a bullish trend or the beginning of a more concerning structural shift. While it’s too early to draw firm conclusions, there are clear signals worth analyzing.

Let’s dive into the charts and uncover what they reveal.

The Big Picture: Is the Bullish Trend Intact?

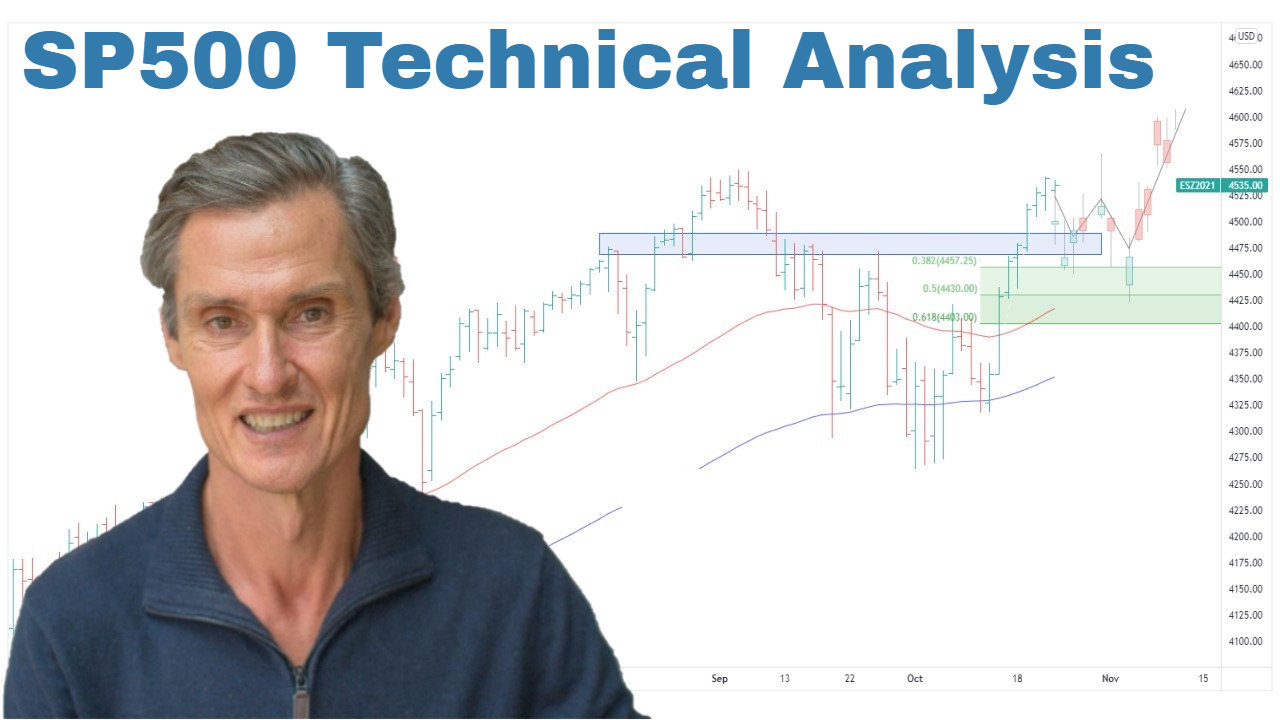

At first glance, the S&P 500’s chart appears healthy. Prices remain above the 100-day moving average, and the 50-day moving average continues to rise. Historically, pullbacks to these moving averages are a natural part of an upward trend, providing opportunities for consolidation before the market resumes its climb.

We’ve seen this pattern several times over the past 12 months, and this type of behavior aligns with the characteristics of a strong, bullish market. The same price structure is evident in the NASDAQ, further reinforcing the case for a broader uptrend.

The Concern: What the Equal-Weighted Index Tells Us

However, when we shift our focus to the S&P 500 Equal-Weighted Index, a different picture begins to emerge. Unlike the traditional S&P 500, which is heavily influenced by a handful of large-cap stocks, the equal-weighted version assigns the same importance to each stock.

In this context, the moving averages are showing early signs of deterioration. The 50-day and 100-day moving averages have started to roll over, and prices have been consolidating below these key levels for the past two weeks. This opens what I call a “window of vulnerability.”

To illustrate the risk, let’s look back to 2022. During that period, a similar pattern unfolded: prices initially fell below the moving averages, began to consolidate, and eventually transitioned into a prolonged downtrend. While history doesn’t always repeat itself, the current structure bears enough similarity to warrant caution.

How Turning Points Often Begin

Turning points in markets often start with subtle shifts in structure, like the one we’re observing now in the equal-weighted index. These changes don’t always lead to major declines, but they’re worth monitoring closely. As investors, it’s essential to recognize these signals early rather than assuming every dip will automatically reverse.

One possibility is that this pullback could evolve into a longer consolidation phase, allowing the market to absorb recent bullishness. This wouldn’t be unusual, especially given the strong rally following the U.S. election. A period of sideways price action could help reset sentiment and set the stage for future gains.

What Does This Mean for Your Portfolio?

The key takeaway here is to remain disciplined. At this stage, I’m not rushing to buy into this dip. Instead, I’m focusing on wide trailing stops to manage risk and ensure I’m positioned to capture long-term trends while protecting capital.

Here are some actionable steps to consider:

- Stay Long, But Stay Vigilant: While the broader trend remains bullish, be prepared to exit positions if they hit trailing stop-loss levels.

- Watch the Equal-Weighted Index: This often provides a more balanced view of the market’s health compared to the traditional S&P 500.

- Don’t Assume Every Dip Is a Buy: Some pullbacks signal deeper structural changes. Look for confirmation before adding new positions.

Pro Tip

If you’re managing a portfolio, now is the time to review your holdings. Ensure that each stock aligns with your risk management strategy and that you have clear exit levels in place. A disciplined, rules-based approach can help you navigate uncertain markets with confidence.

Final Thoughts

While the S&P 500’s bullish trend remains intact, the signals from the equal-weighted index suggest it’s time to proceed with caution. Whether this pullback evolves into a more significant turning point or merely consolidates, staying disciplined and prepared will put you in the best position to succeed.

By focusing on clear rules and managing risk effectively, you can confidently navigate whatever the market throws your way.

👉 Want to stay ahead of market trends? Join our Weekly Strategy Sessions.

Looking for the best ASX stocks to buy now?

Motion Trader‘s algorithms scan more than 2,000 ASX stocks daily in search of medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

Try a no obligation FREE 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.

Video Links

For reference to the topics discussed:

08:30 Is the SP500 pausing or topping?

10:00 This is how turning points start

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).