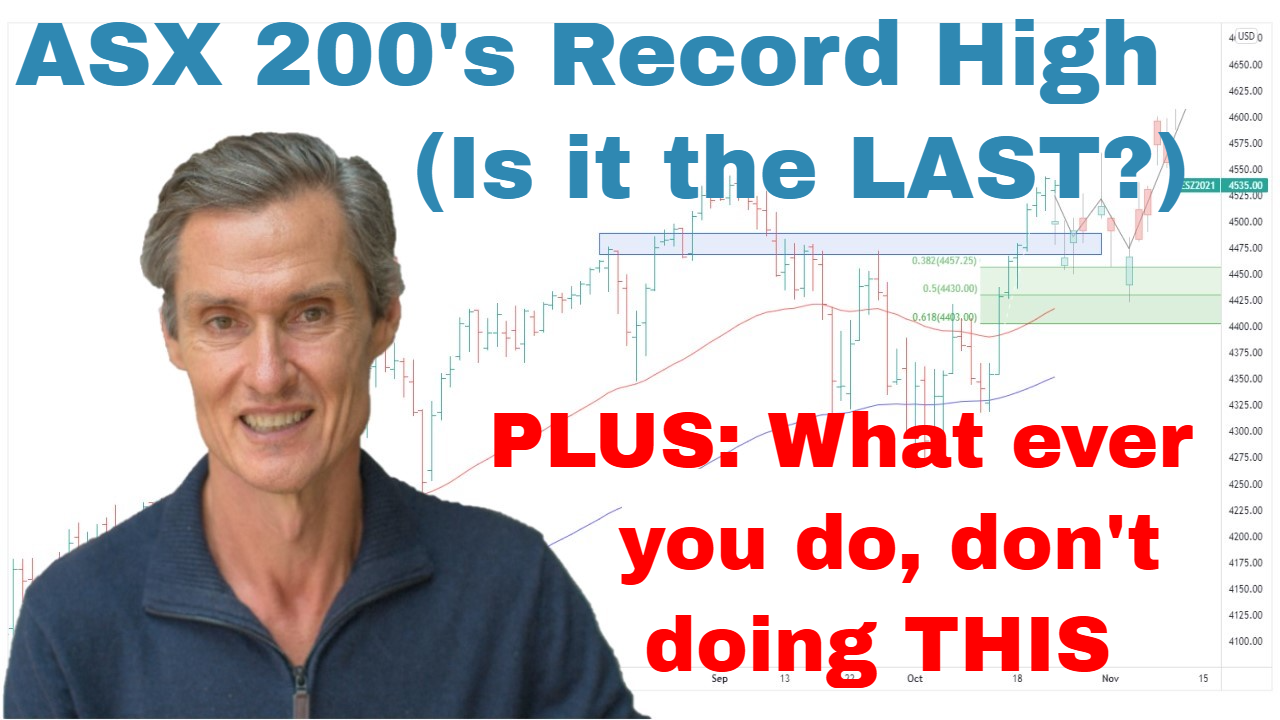

ASX 200 Technical Analysis: Navigating New All-Time Highs | Episode 265

By Jason McIntosh | 22 November 2024

The Australian Securities Exchange (ASX) 200 has finally caught up with the U.S. markets by reaching a new all-time high. This milestone raises important questions about the future direction of the market. Is this the beginning of a sustained rally, or should investors be cautious about a potential market top?

Understanding Market Psychology at All-Time Highs

Investors often face psychological challenges when markets hit all-time highs. Common wisdom suggests buying low and selling high, leading some to believe that high markets indicate it’s time to sell. However, strong stocks and markets often continue to trend upwards, demonstrating that trends can persist even at elevated levels.

Technical Analysis Insight: Trends and Pullbacks

Trends represent the consistent movement of prices in one direction over time. While pullbacks are natural, they don’t necessarily signal the end of a trend. Learn more about understanding market trends.

ASX 200’s Recent Performance

The ASX 200’s recent rally above its previous high from October is noteworthy. Despite expectations of a pullback towards moving averages, the index has continued its upward momentum, suggesting strong underlying market support.

Key Technical Indicators: Moving Averages

Moving averages are crucial in assessing market trends. The ASX 200 remains above its rising 50-day and 100-day moving averages, indicating a bullish price structure. Discover more about moving averages.

The Equal Weight Perspective

Interestingly, the ASX 200 on an equal weight basis has not confirmed the new high seen in the main index. This “non-confirmation” can sometimes be a warning sign but may not be significant in this context due to the overall bullish structure.

Technical Term: Non-Confirmation

Non-confirmation occurs when one index reaches a new high while another does not. It can indicate potential market divergence but isn’t always predictive of a downturn.

Looking Ahead: Potential Scenarios

- Continued Uptrend: The underlying path of least resistance appears to be upward, with strong buying interest on dips.

- Short-Term Consolidation: A relatively brief consolidation (possibly several weeks) is possible in the near term, but shouldn’t threaten the overall trend.

- Breakout Confirmation: If the equal weight index surpasses its October high, it would confirm the broader market’s strength.

Conclusion: Optimism with Caution

The ASX 200’s new all-time high is a positive sign, reflecting continued investor interest and capital inflow into stocks. While it’s essential to manage risk and remain vigilant for signs of trend reversals, maintaining exposure to equities appears prudent until evidence suggests otherwise.

For more in-depth analysis of Australian stocks and global markets, consider exploring our weekly Strategy sessions.

****

Want to learn more about trend following and risk management strategies?

Take a Free 2 week Motion Trader trial

****

Video Timestamps

00:00 Intro

00:30 ASX 200 catches up to SP500 (but is the run ending?)

03:00 I view all-time-highs like this (it’s different to many people)

04:40 Should you worry about the non-confirmation in ASX 200 Equal Weight Index?

07:10 SP500’s pullback suggests THIS happens next

10:25 Key index tells us a lot about the US market’s health

11:37 Whatever you do, don’t do this!

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).