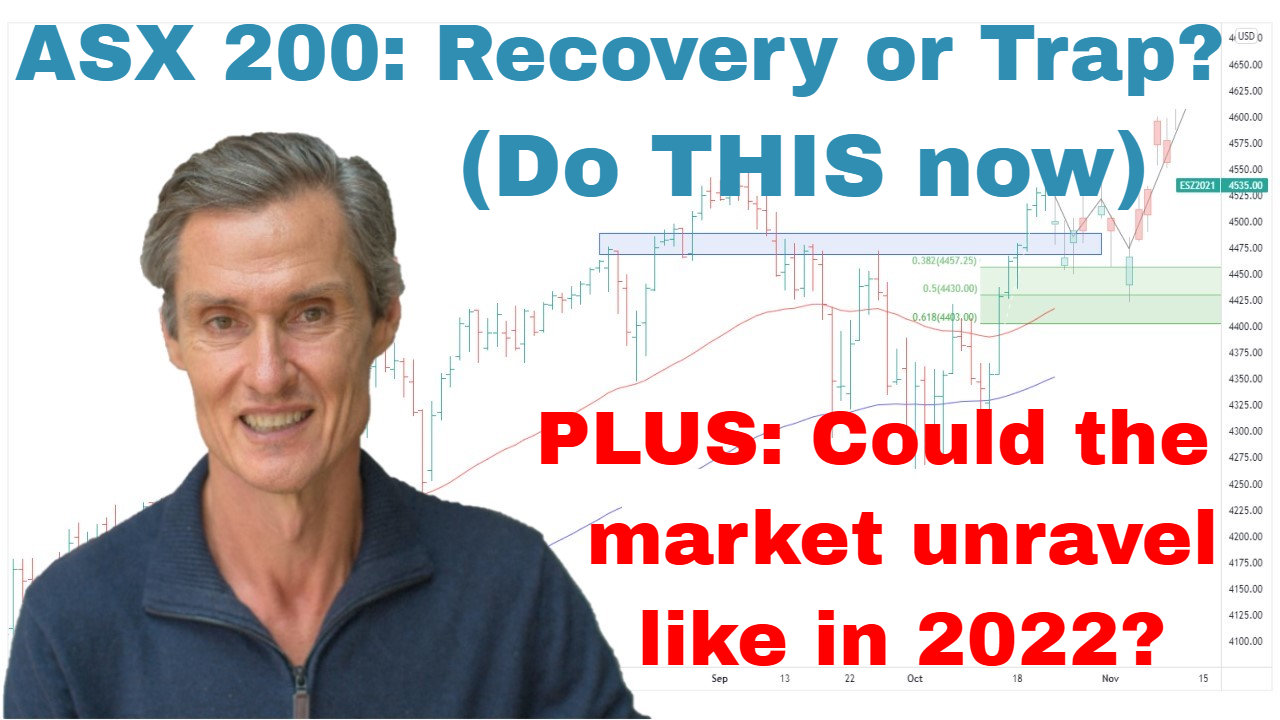

ASX 200 Rebounds — But a Bigger Risk May Be Lurking | Episode 287

By Jason McIntosh | 26 March 2025

ASX 200: A Tentative Recovery Beneath Key Averages

The ASX 200 is on track for a second consecutive positive week—something we haven’t seen since early February. While a rebound is welcome, it comes against a backdrop of declining 50- and 100-day moving averages. That begs the question: Is this rally to be trusted?

What’s Happening Technically:

- Despite back-to-back gains, price action remains below declining moving averages.

- The rebound lacks momentum—we’re not seeing the snapback strength that often follows panic selling.

- The structure suggests increased vulnerability—a market consolidating beneath falling averages can be a setup for further weakness.

Equal-Weight Perspective:

- Some argue that the ASX weakness is bank-driven. But a look at the ASX 200 Equal Weight Index tells a broader story.

- The equal-weighted index has also stalled beneath resistance at 1,920, with price action similarly sitting below declining averages.

Why This Structure Matters:

When a market consolidates below declining moving averages, the odds shift. It doesn’t guarantee lower prices—but history shows this setup often leads to more weakness, or at best, messy consolidation periods.

“It’s not about panic—it’s about managing risk while waiting for stronger price structures to re-emerge.”

S&P 500: Watching the 200-Day Moving Average Closely

The S&P 500 is also rebounding, but like the ASX, this recovery is more of a slow grind than a surge.

Key Observations:

- The index remains below its 200-day simple moving average, a threshold that often signals elevated risk.

- Quick rebounds tend to happen within a few days after dipping below this line. When prices stay below for 2+ weeks, the chances of a deeper pullback or multi-month consolidation increase.

Historical Perspective:

Looking back to the GFC and more recent pullbacks:

- Quick rebounds = short-term dips.

- Longer stays below = trouble. Often leads to extended volatility or bearish trends.

Paul Tudor Jones once said, “Nothing good happens below the 200-day moving average.” While not a hard rule, it’s a powerful sentiment.

Sentiment Indicator: Bearish Extremes May Be a Good Thing

A fascinating chart from Sentiment Trader reveals:

- The American Association of Individual Investors (AAII) has shown 5 consecutive weeks with more than 50% bearish sentiment.

- Historically, these sentiment extremes often line up with market lows—but they don’t guarantee immediate turnarounds.

The Cautionary Note:

- Bearish sentiment is a setup, not a signal.

- To act on it, we need positive price action—otherwise, it’s just an extreme that could get more extreme (as seen in early GFC stages).

Strategy and Positioning

Both markets are showing early signs of stabilizing, but the technical damage remains. With prices below key moving averages and sentiment stretched:

Jason’s Playbook:

- Reduce exposure where appropriate.

- Hold long positions with wide trailing stops.

- Avoid panic selling, but don’t rush back in.

- Look for leadership in price action before becoming more aggressive.

There’s no need to predict the bottom. A strong rebound could still emerge—but until we see price back above key averages, it’s a time for cautious optimism, not aggressive buying.

👉 For a deeper dive into technical analysis, check out our Weekly Strategy Sessions.

Motion Trader‘s algorithms scan more than 2,000 ASX stocks daily in search of medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

Try a no obligation FREE 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.

Take a Free 2 week Motion Trader trial

Video Timestamps

00:00 Intro

00:40 ASX 200 rallies (but should you trust it?)

04:15 It’s not just the banks selling off (look at this chart)

06:00 The big risk when the chart structure changes

08:35 I’m doing THIS right now (you could do the same)

11:35 SP500 isn’t getting a “buying thrust” – should you worry?

13:25 Look what happens below the 200-day moving average

20:50 Is the extreme bearishness a buy signal?

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).