ASX 200 Extreme Sell-Off! Is There More to Come? | Episode 285

By Jason McIntosh | 14 February 2025

📈 Global Market Wrap: ASX 200 & S&P 500 at Crucial Turning Points

Why history says this sell-off might be an opportunity… and how to prepare for what’s next.

🔹 Key Points at a Glance

- ASX 200: Down 10% from all-time highs, testing major support at 7,600.

- S&P 500: Moving averages are close to crossing—will a rally arrive in time?

- Nasdaq: Breaks its historic run above the 200-day moving average.

- Extreme pessimism suggests opportunity—but caution is key.

🇦🇺 ASX 200: Testing Critical Support Levels

The ASX 200 has just wrapped up four consecutive weeks of losses, marking one of its most aggressive reversals in over a decade. From its all-time high just a month ago, the index has tumbled 10%.

Is This an Ugly Shakeout or the Start of Something Bigger?

This kind of reversal is rare—happening perhaps once or twice a decade. History suggests that after such sharp sell-offs, the market often stabilizes and rebounds… but there are no guarantees.

Important Levels to Watch:

- 7,900 and 8,100 (previous support) have already failed.

- 7,600 is the next significant support zone.

- This level includes major highs from 2021–2022 and panic lows from April and August 2023.

- A failure here could open the door to a deeper correction.

What the Data Tells Us:

- The All Ordinaries index is 6% below its 50-day moving average, a level that has historically marked oversold conditions.

- While not foolproof (see the COVID crash for exceptions), this often precedes strong rebounds.

📝 Takeaway:

Rather than panicking, experienced investors are sticking to their rules, using wide trailing stops, and preserving cash for better opportunities.

🇺🇸 S&P 500 & Nasdaq: Trend at a Crossroads

Nasdaq Breaks Below Its 200-Day Moving Average

The Nasdaq closed below its 200-day moving average, ending the second-longest run in history above that key level. While this doesn’t guarantee a bear market, it signals technical damage and a weakening trend.

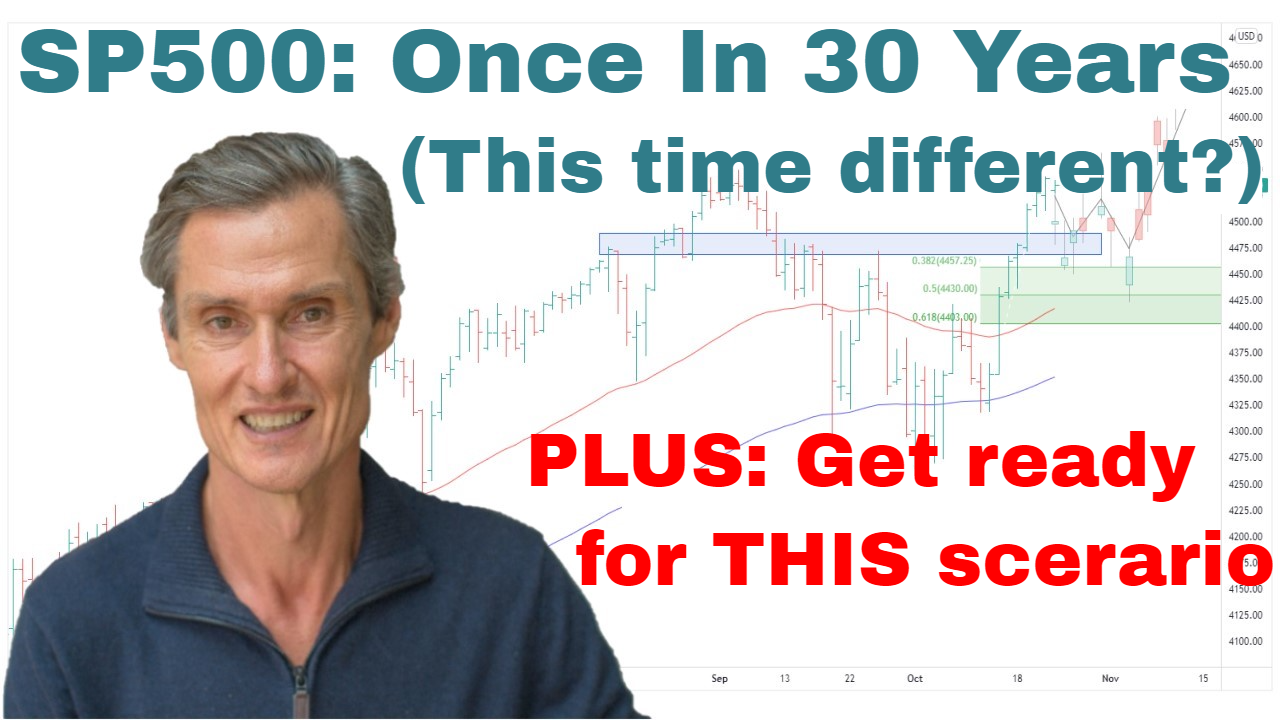

S&P 500 Moving Averages: Danger Ahead?

The 50-day and 100-day moving averages are on the verge of crossing.

- A strong rally could negate the bearish signal.

- A weak bounce, however, might confirm an ongoing decline.

Sentiment Reaches Extreme Pessimism

The AAII Sentiment Survey hit its seventh highest bearish reading ever.

- These levels often coincide with notable market lows.

- But extreme fear can get even more extreme before turning.

📝 Takeaway:

This is not a global sell-off. Markets in Europe, Asia, and South America remain relatively stable. The US Mega caps and small caps are feeling the brunt of the pressure.

✅ How to Navigate This Environment

Whether you’re trading the ASX 200 or the S&P 500, the principles are the same:

- Stick to your strategy—don’t panic sell.

- Use trailing stops to protect against major downside.

- Preserve capital so you can take advantage when conditions improve.

- Avoid trying to pick the bottom. Wait for confirmation.

🔚 Final Thought: Cautious Optimism Wins

The market remains volatile and unpredictable.

History suggests a rebound is likely—but managing risk is key.

“Panic rarely pays off. Sticking to a process does.”

—Jason McIntosh

👉 For a deeper dive into technical analysis, check out our Weekly Strategy Sessions.

Motion Trader‘s algorithms scan more than 2,000 ASX stocks daily in search of medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

Try a no obligation FREE 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.

Take a Free 2 week Motion Trader trial

Video Timestamps

00:00 Intro

00:40 ASX 200: Can an extreme sell-off get bigger?

03:45 This is the key level now (this is the big one)

05:15 Look what this indicator points to next (most won’t believe it)

15:15 This is the #1 thing to do right now

17:30 Nasdaq breaks a big milestone (and it’s not good)

19:15 SP500 about to meet a bearish condition (but….)

20:25 What this surprising statistic means for the market

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).