What is Momentum Investing?

By Jason McIntosh | 7 August 2021

If you’re new to the world of share trading, chances are you will have heard of the term “momentum investing”. And you may find yourself asking, what is it exactly and is momentum investing a viable strategy?

This article explains what you should know about momentum investing and how it fits into an online share trading strategy. By the end of this, you’ll have a firm understanding of momentum investing and how to trade shares successfully using this approach.

What is momentum investing?

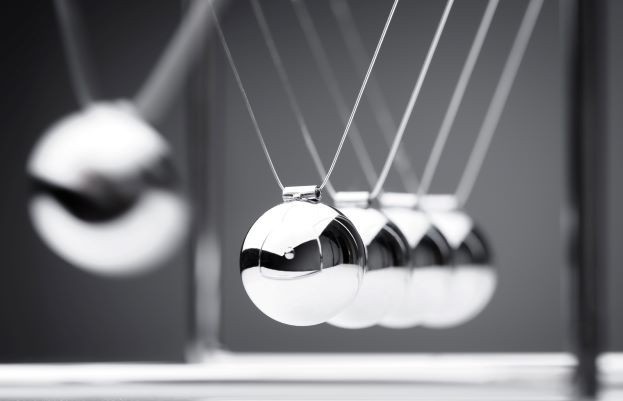

Momentum investing is a strategy that involves investing in companies that are going up in value and selling them after they peak and turn lower. As the name suggests, it’s all about investing in the direction of the share price momentum. It works on the basis that price momentum can persist for a long time, and that it’s possible to make large profits by following these trends.

A momentum trade typically ends when a stock loses momentum and falls back. An investor can then exit that stock and reinvest capital in new stocks using the same approach.

Some people worry that a pure momentum strategy doesn’t consider a company’s fundamentals. But just like you don’t need to understand hydraulics and engineering to benefit from a car, momentum investors don’t need to understand the inner workings of a company to potentially profit from a rising share price.

That said, some investors use a hybrid approach. They use momentum strategies to identify opportunities, and then apply fundamental analysis to zero in on the stocks they believe have the most potential.

If you’re into fundamentals, you can learn more about factors affecting share prices in this post on 7 Key Factors Affecting Share Prices.

What are the key elements of momentum investing?

There are a few key elements that make up the concept of momentum investing.

First, it’s important to apply this approach over a complete market cycle. This is because, like all strategies, momentum investing doesn’t work all the time. For example, momentum strategies often struggle when the market (or a stock’s share price) is trading sideways.

By following the process over a long period, it increases the odds of suitable investment conditions. Momentum strategies for buying stocks typically work best during the market’s bullish phases.

Secondly, momentum strategies can be highly effective with growth stocks. This is because companies with unique appeal such as Afterpay, Apple and Tesla can potentially rise hundreds of percent. And momentum strategies are well suited to identifying these moves relatively early, and then profiting from them as they extend higher.

How does momentum investing work?

Momentum investing often involves a set of rules that identify entry and exit levels for a particular stock or market (e.g. the All Ordinaries). The rules may involve technical indicators like moving averages or price breakouts.

Motion Trader uses two moving averages (50-days and 100-days). A stock is a potential buy when the shorter term average crosses above the longer term average. It also applies a breakout strategy for timing of the actual entry signal. This works on the principle that momentum indicates the path of least resistance.

Depending on their timeframe, momentum investors could use shorter or longer term moving averages for signalling purposes.

The benefits of momentum investing

The nature of momentum investing is such that you can potentially make substantial profits in shorter periods of time as you are only committed to shares for as long as they meet the momentum criteria. This is different to buy and hold investors who may stick with a stock during lengthy periods when a stock isn’t performing.

Momentum investing also aims to makes the most of volatile markets, seeking out shares that are rising in value and selling them when the market changes.

As a strategy, momentum investing is typically rules based. The systematic nature of the approach helps avoid emotional decisions about when to buy and sell. And by following the rules consistently, , a momentum investor can help increase the chances of achieving repeatable success.

Does momentum investing really work?

The short answer is yes — it’s a straightforward approach that has been around for decades, if not centuries. The key is to apply the strategy with consistency over time.

The theory aligns with the basic advice shared in this post on 3 Skills to Make Investing for Beginners Child’s Play: Buy when prices are rising to maximise the chances of profitability.

Another noteworthy point is that a rising stock price can have a positive effect on a company’s overall performance. Upward momentum often creates greater awareness which may attract new investors and push the share price even higher. This concept is known as “reflexivity” — when good things happen, it fuels more good things to happen in its wake. And momentum strategies are well suited to profit from this positive feedback loop.

Making educated choices about your investments

If you are starting out in the world of stocks and share trading and wondering how to trade shares in Australia, then momentum investing may be a good place to start.

And you don’t have to do it alone. Motion Trader is a share trading advisory service that can help you accelerate your learning curve and understand investment approaches such as momentum investing.

Motion Trader’s algorithms identify share price momentum, and then calculate precise buy and sell levels for ASX stocks. So, instead of relying on “hunches”, you have real insight to help you make educated choices about your investments.

Looking for a free stock market training course?

Learn how to identify some of the best stocks to buy now in this free video training. You’ll learn a complete stock trading strategy for buying and selling shares with confidence. We’ll also share real life examples to help you apply the knowledge and build a profitable share portfolio.

Where to invest now?

Looking for ASX stocks to buy now, as well as off the radar ideas most people don’t know? Our algorithms scan the stock market daily for medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

If you’re ready to get started, try a no obligation 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).