Discover 5 Powerful Trading Strategies of Top ASX Investors

Learn to Apply These Proven Strategies to Your Portfolio!

• Learn time-tested strategies used by professional traders and active investors

• Discover how to minimise risk and maximise profits

• Gain insights to help you make more informed trading decisions

• Applicable for both novice and experienced ASX investors

What we provide

Share trading advice we use ourselves

Motion Trader is for active investors who value robust analysis, data driven entry and exit signals, commentary, and education. Our share trading advice can help you grow your wealth and manage risk. You'll receive specialised, expert stock market research that’s ready to action through your broker.

Our algorithms scan the ASX daily for medium-term investment trends. We also share our own results so you can build confidence and trust in the process. It's all about giving you the tools and experience to take control.

Explore Our Free Trading Strategy Series

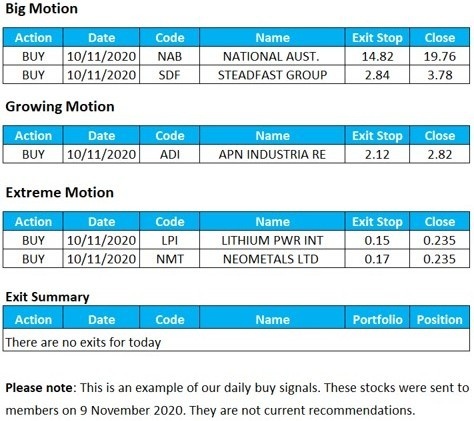

Get a shortlist of high potential ASX stocks each day

We use custom algorithms to zero in on high potential investment opportunities. The stocks we cover range from the largest companies to fascinating small caps that few people know about.

Our approach involves a series of trend identification techniques. These time-tested strategies are applied with consistently by algorithms.

Members receive a daily email with the latest opportunities (at around 7 pm). Our advice is clear-cut, with precise instructions for when to buy and sell.

You'll see an example of our signals email to the left. It has all the information you need to place a buy order. No guesswork. Just algorithmic precision.

But does it work?Could You Use an Extra $1,149,331?

When you buy a Motion Trader stock, you know that Jason (Motion Trader's founder) is using the same process for his own portfolio.

He's not just talking the talk… he's also walking the walk.

On 28 Sept 2015, Jason put $500,000 into a model trading account. His aim was to build a real life track record using the same process he offers publicly.

As of 31 December, his account had grown to $1,649,331 - a profit of $1,149,331.

The graph shows Jason's total profit (excluding starting capital). It includes open and closed trades, dividends, franking credits, and brokerage charges.

Does your advisor "walk the walk"?

See inside Jason's real-life portfolio"Successful trading isn't a secret, it's a formula... a series of consistent and repeatable time proven steps."

Get real experience on your side

Hi, my name is Jason McIntosh, the founder of Motion Trader — an online algorithmic advisory service for active investors with a passion for markets and the desire to have hands on control of their portfolios.

I've been a professional investor/trader for over three decades. I began my career in 1991 at the Sydney HQ of a leading Wall Street investment bank. My mentors were some of the best traders in the business. I learnt how markets move and how to trade them. My systematic trading style saw me evolve into a senior, and consistently profitable trader.

Since leaving the bank in 1999, I've been a founder of two stock advisory firms and a fund management business.

I gave up the hustle and bustle of the CBD in 2007. Nowadays, I manage my family's investments from home in Sydney. But what I most enjoy is helping regular people outperform the market and manage their risk.

My Motion Trader strategies have helped thousands of people learn to trade ASX stocks in a consistent and repeatable way.

And best of all, it's more achievable than many people think.

Trusted by Experts and Everyday Investors

Market beating performance

"I am more confident to increase my trading because I can monitor risk. I also sleep better at night. The result of trading with Jason, for me, has been market beating."

- James D, Engineer, South Australia

Make money while you learn

"I found Jason’s system and my trading world changed. Jason is also a wonderful mentor. I’m such a better trader because of him. I recommend the service highly."

- Kim B, retired Business Owner, NSW

Absolutely awesome!

"I've followed Jason's work since 2000, and his trading services since 2014. They are absolutely awesome. Jason will change the way you trade, and teach you as well."

- Jennifer G, Financial Services, Sydney

Trading Strategy is working

"Jason, you have positively changed the way I manage my portfolio. Your system has taught me let the profits run, and cut the losses quickly. This strategy is working."

- George S, Geophysicist, Perth

Amongst those special few

"Jason, I cannot praise you enough for your inspirational leadership and success. I have in silent awe followed all your trade notifications and weekly tutorials."

- Eric M, retired Engineer, Melbourne

I'm now a share market investor

"Jason, thank you for breaking me free of all my old share market gambling habits. I needed a strategy, one that you were able to provide. I don’t fear losing any more."

- Peter T, Geologist, Sydney & Vientiane

Ready to get started?

All the tools to help you build a market beating share portfolio

A key element of our service is to help develop your skills in trading shares. In addition to receiving specific buy and sell instructions, you’ll also learn how the process works.

We teach members how to identify, manage, and exit stocks via a weekly mentoring report. Motion Trader doesn't just tell you what to do, we also explain how to do it yourself with our easy-to-understand instructional videos and trading guides.

But does it work?We're serious about your success

Educate

Don't just follow our buy and sell signals, learn how the process works. Our weekly mentoring reports help build your skills.

Buy & sell signals

We'll tell you exactly when to buy and precisely when to sell stocks. No more gut feel. You'll know what to do every time.

Support

Questions are a key part of the learning process. If you're unsure about any aspect of the service, we're hear to help.

Experience

Our founder began his career in the Sydney HQ of a Wall Street bank in 1991. Trading is what he does, and he's been at it for 3 decades.

_____________________________________________________________________________________________________________________________________________________________________________________________________

Get the 5 Step Process Jason Uses to Beat the Market

Jason explains how he built a 7 figure share portfolio_____________________________________________________________________________________________________________________________________________________________________________________________________